When Renewable Energy Meets Power Grid Operations

The electric power industry faces much turmoil in the coming decades. The business model of the electric utility company (public or private) may not survive. In addition, the power needs of high-density cities may diverge significantly from non-urban areas causing political turmoil and technical hurdles.

The increasing share of renewable energy will be a major factor in the turmoil. It can be viewed as a coming of age. When the percentage contributions of solar & wind to the power grid were small enough, it didn’t matter how they behaved. But as their share grows, renewables become significant and ultimately dominant.

There’s nothing new about turmoil, or upheavals. Technologists are sometimes proud of the disruptive nature of their inventions. But in the case of electric power, we must never stumble in the reliable supply of electricity, not even for brief periods. A total revamp while maintaining continuous operation is like reupholstering the seats in your car as you drive down the highway.

I am talking about the future. No, I do not own a crystal ball. My approach is to describe the essential properties of a reliable power grid that must remain invariant despite turmoil, conflict, and invention. If renewables are to dominate the future, then renewables much take over these necessary functions. This article may be a bit wordy but bear with me.

Design and operation of the bulk power grid have been my career. My examples come from the State of New York, USA. In other states and countries and other utility structures, the nomenclature and ownership details may seem very different, but the things I describe here are analogous to power grids anywhere in the world.

Table of Contents

Caveat

This article discusses the bulk power system and the wholesale markets, not distribution not retail, not personal use or personal costs, or personal production. To understand this article, you must think of energy supply at the level of continents, not individual homes or neighborhoods or even individual countries.

Operating the Grid — Balance Generation and Load

The power grid is demand-driven. Customers create demand, for example by turning on a light. The grid must satisfy this demand instantaneously, creating a balance: generation=load+losses. For purposes of this article, I will neglect losses and say generation=load. It would be correct to say production=consumption, but I prefer generation=load. Our foundational physics principle is the is conservation of energy.

The power grid stores no energy, so this balance must apply instantaneously. Energy storage we can treat as external devices attached to the grid. They are not part of the grid itself. In an earlier Insights article, I discussed maintaining the balance over a wide range of time intervals; the longest interval ##10^{18}## times longer than the shortest. In this article, we’ll zero on on a mere ##10^{5}## range of time intervals from about a minute to a year.

So that’s it. Customers demand power whenever and wherever they want to. The industry must assure that generation matches load and deliver that energy to the customer’s location in all reasonable circumstances at an affordable price. Pretty simple huh?

The Solution: Find the Optimum Allocation Among Multiple Sources

It is necessary to have multiple resources and multiple ways to meet the demand. Each resource has different properties, a geographical location, and a price curve. Therefore, the technical problem is reduced to simple optimization. Find the optimum combination of resources to make generation=load subject to constraints. The familiar Simplex method is widely used to do that. We repeatedly solve that problem once every hour for the next 24 hours, once every 15 minutes for the next hour, and once every 5 minutes for the next 15 minutes, and in a limited sense once every 2 seconds for the coming 5 minutes.

Now let’s talk about the scale of the problem. The New York grid is a network with roughly 20K nodes and 100K branches. It is a linear passive electric circuit. The nonlinear boundary conditions are the power flows entering/leaving the grid at each node. Ohm’s Law, Kirchoff’s Laws, and matrix methods are the primary tools used to solve it. During optimization, every vertex considered must calculate the voltages at all nodes, and the power flows in all branches.

The geographical and electrical locations are critically dominant factors. We can and we do generate electricity near Hudson’s Bay in Canada that is consumed in NYC, but we can’t do it as reliably as power generated locally on the island of Manhattan.

As a prerequisite to the circuit solution, we need to decide what circuit is being solved. To do that, we run a state estimator program. Think of a large and geographically distributed data acquisition system with partially overlapping measurements. Add to that, manually entered parameter values which may be inaccurate. It is inevitable that some data is incorrect or missing. Even circuit breaker statuses can be misreported. Entire remote telemetry facilities can be wiped out. The data will never be perfect, but the calculations need to be executed nevertheless. The state estimator provides us with the best guess for the actual circuit and boundary conditions that need solving; a guess that completely obeys Ohm’s Law and Kirchoff’s Laws.

Now think of constraints. Every node has a maximum and minimum voltage. Every generating source has a max and min power and a max ramp rate of change. Every transmission line has a weather-dependent max power rating and a short-term overload capability. About 150K constraints may not be violated.

Next, come contingencies. Every branch in the network and every generating source may fail during the time period considered. We apply all contingencies to every possible solution and verify that no constraints are violated. If a violation is predicted, that solution is discarded. We apply all contingencies singly to the entire state, all combinations of contingencies taken 2 at a time to NYC, and all combinations took 3 at a time for the island of Manhattan. Altogether about 250K contingencies are evaluated for every vertex in the Simplex solution. Remember that each of those 250K calculations requires solving for 20K voltages and 100K power flows. It makes for a lot of number crunching.

Sometimes constraints can consider emissions. For example, there used to be some older power plants in NYC that could burn dirty oil or cleaner gas. Naturally, it was policy to use gas as much as possible. But one contingency was the loss of the gas pipeline. So in rare cases, the plants were ordered to burn dirty oil if it was determined that the grid could not survive the loss of that gas pipeline. The optimum solution would calculate the maximum amount of dependency on gas.

After all that complexity, what is the objective function to be optimized? It is a single scalar number; total cost.

The Energy Auction

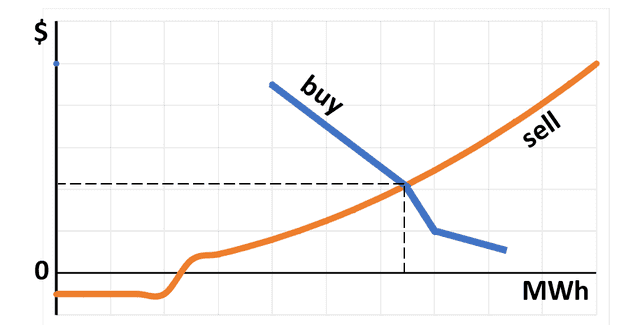

Costs are determined by an auction. Each seller and each buyer provides one or more bids; each bid for a specified MWh quantity, and a dollar price. The bids are ordered and cumulative curves a drawn. The intersection of the curves is the solution. The dotted lines in the figure show the clearing price and the clearing quantity. All bids to the left of the clearing quantity are accepted and all are paid the clearing price regardless of their bid price. All bids to the right are rejected; those sellers and those buyers go home empty-handed.

That auction method is the same as stock markets use to determine stock prices and quantity bought and sold.

Note that part of the selling curve is negative. Remember that for later in this article.

It is easy to visualize prices fluctuating in response to changes in the supply curve or the demand curve. During heat waves, demand is high. During economic recessions, demand is low. When a power plant breaks down, the supply curve shifts. Solar and wind supply for tomorrow depend on tomorrow’s weather forecast. Price volatility depends on how steep the slopes of those curves are. For example, gasoline prices all over the USA increased about 10% in the past month because of mechanical problems at a single refinery. There is no defined limit to how close to vertical those curves can be.

Of course in real-time, utilities have no flexibility; they must buy whatever retail power customers demand. However, the biggest auction is held the day before, so the utility has the option to buy some energy in advance or buy the rest later.

Other Vital Services

Reserves: Things break. We must have spares and backups for the times when they do break unexpectedly. Therefore we require power reserves on the order of 15-20% of the load. Reserves are generation capacity that is paid to be ready but to not actually generate. In NY, we buy reserves of three types: instantaneous, 15-minute notice, 30-minute notice. The price paid for reserves is determined by a separate auction.

Frequency control: Any unbalance between generation and load+losses results in the frequency going up or down. Some fraction of generating capacity must be available to follow that second-by-second in closed-loop control to keep frequency reasonably constant. A generator must run below 100% capacity to be able to respond up/down on command. Prices for frequency response are determined by a separate auction.

Voltage Support: This is mostly a question of reactive power; VARS. The network may need plus or minus VAR generation at strategic points to help maintain voltages within limits. The price paid for voltage support is determined by a separate auction.

Black Start: After a blackout (horrors!!!) the grid must be restarted. That is not necessarily easy. After the 1965 NE blackout, power plants on Long Island had to burn office furniture to light the fires. Most power plants need electricity to operate their controls. The grid needs sources capable of starting without outside help, and with enough capacity to energize the entire grid so that other generators can be started and loads reconnected. The price paid for black start capability is determined by a separate auction.

Demand Response: To balance generation=load+losses, it should make no difference whether we increase generation by 1MW or decrease the load by 1MW. A few customers, who have the flexibility to put their loads under the computer control of the grid operator are paid handsome fees to do so. For example, mining and rock crushing. Some of them can crush enough rock for a year’s product with the only one 1-month of operation of the crushers. That gives them great flexibility to schedule when they consume electricity. In the future, demand response providers may participate directly in the energy auction.

ICAP: ICAP is short for installed capacity. It is essential that there is sufficient generating capacity ready to bid in the energy markets for each region. If utilities own all the resources, the government requires them to provide adequate ICAP. If not, the government requires them to purchase it from third parties. Yet another separate auction can be used to buy and sell ICAP.

Suppose New York is short on ICAP for next year. Third-party investors may be sour on NY, thinking that profits are too low there to be profitable. What can be done to motivate them to build a new power plant in time for next year? Bribe them of course. ICAP payments are the bribe. There have been legal fights over whether states have the authority to mandate that certain percentages of ICAP be renewable. There are also legal fights in some places about the eligibility of solar and wind for ICAP payments.

What is the difference between reserves and ICAP? Mostly the time scale. Reserves are bought for tomorrow, ICAP for next year.

Renewables Take Over

Energy/Reserves/Frequency Control/Voltage Support/Black Start/Demand Response: those are the essential invariant services of the grid. Heretofore they have been provided by conventional means, especially hydro and steam power plants. Note that all services except energy require that the provider produce less than the maximum possible power.

As solar and wind grow as a fraction of the total, they must assume a share of the responsibilities. If they take over 100% as many people dream of, they have 100% of the responsibility. Opinions about what fraction they should be are irrelevant.

We already have a problem. Remember the negative portion of the sell curve? That is real, and in certain locations every once in a while the clearing price goes negative. Generators must pay for the privilege of producing power. Nuclear plants make negative bids because they can not shut down for just one hour and restart for the next hour when power demand is higher. Solar and wind generators can make negative bids because they can make a profit with subsidies alone even if they pay to the grid for the privilege. Negative prices used to be rare, but it is happening more and more often in more places and that threatens the whole financial model.

If you understood this article, you see how the technical operation of the grid is intimately co-dependent on the economics and financial auctions. Auctions have a critical assumption — the cost-versus-production-curves must have nonzero slopes. That does not apply well to wind and solar. If negative prices become too frequent, the auction system collapses and we must find something other than money to be the objective function for optimization. What could that something be? I have no idea. But the prospect of such a fundamental change threatens disruption, and disruptions in the delivery of energy are unacceptable.

Even experimentation and change with fundamental markets are risky. We are talking about hundreds of billions of dollars per year. The incentive to steal, cheat, or manipulate is huge. If you remember, we already saw what happened in 2000 with disastrous rolling brownouts in California. There, the crooks proved to be more clever than the market designers, and much more clever than the regulators. Innovation and prudence do not mix well for vital services.

In most contexts, I am a stalwart advocate of change, but in this case, change scares the hell out of me. My fears apply equally to regulated, deregulated, public, and private electric industries.

Dick Mills is a retired analytical power engineer. Power plant training simulators, power system analysis software, fault-tree analysis, nuclear fuel management, process optimization, power grid operations, and the integration of energy markets into operation software, were his fields. All those things were analytical. None of them were hands-on.

Dick has also been an exterminator, a fire fighter, an airplane and glider pilot, a carney, and an active toastmaster.

During the years 2005-2017. Dick lived and cruised full-time aboard the sailing vessel Tarwathie (see my avatar picture). That was very hands on. During that time, Dick became a student of Leonard Susskind and a physics buff. Dick’s blog (no longer active) is at dickandlibby.blogspot.com, there are more than 2700 articles on that blog relating the the cruising life.

Ah, got it. My sideways reading skills are a little rusty…

Only 13% renewables that depend on the weather.

Check the right edge.

I agree that more discussion of that would be off-topic.

https://edition.cnn.com/2019/05/09/health/uk-coal-electricity-renewables-health-scli-intl/index.html

Fair point. The thread is caused by the rate of change of new technology, and by the property of these two new sources that their marginal costs for the next MW are nearly zero.

I am neutral regarding all technologies that can service the grid. I do not advocate for or against any such technology. What I fear is chaos, or disruptive changes that threaten reliable affordable supply.

So I guess it does sound like a paradox. The attractiveness and low prices of solar/wind threaten to bring change so fast that chaos could result. I think I made the analogy of reupholstering the seats in your car while you drive down the highway. That does not mean new upholstery is bad.

I don't think it's just a matter of forgetting. Civilization as we have it now has added a lot of features that are only enabled by having ubiquitous electric power. (The medium by which we are having this conversation is one of those features.) Those features would have to be given up if we somehow lost all electric power, which doesn't seem like a very attractive option. But there is certainly much to be gained from figuring out how to still provide those same features but with less electric power, or at least less electric power that requires costly infrastructure to generate and distribute.

For example, even if solar panels on my roof can't always provide enough power by themselves to run my refrigerator and air conditioner, they probably can provide enough power to keep the batteries on every digital device in my house charged; and with not that much battery backup they can probably keep all of the LED light bulbs in my house (which is now every light bulb in my house) on for the times that we have them on. They might even be able, with not too much battery backup, be able to keep the LED TV on for the times that we have it on. Up to now we have just powered all that stuff using 120V AC outlets, with a lot of AC/DC converters attached to individual devices, because that was easy and cheap. But there might come a point where on net it is actually more cost effective to uncouple low power devices from that 120VAC grid.

You're entitled to your opinion. In #33 I said:

So my opinion is that solar/wind have gotten a tremendous boost in attention because they are green, but now they are just attractive power generation technologies independent of their green qualities.

Also IMO, the goal is reliable and affordable power is the goal, green or brown. Without power, we loose the ability to move anything forward or make anything greener. We have forgotten how to run civilization without electric power.

That depends on the numbers obviously.

Being "prematurely obsoleted by new technology" is not unique to the power industry.

Some of us may still own AT&T rotary dial phones. They were built to last 45 years, but they

(and the later touch-tone phones) were obsoleted far in advance of their design lifetime. In phones, we are now so used to rapid obsolescence that the idea of designing a phone for 45 year life would be ludicrous. The same applies to PV panels in the modern world. A wise project manager considers upgrades during the lifetime of the project as foreseeable.

Haven't we rejected "greenness is the goal" several times already in this thread?

They're very rarely studied and talked about. But I don't think that means we know for sure that they're rare. For one thing, there should be an obvious positive impact on plant growth and therefore crop yields.

Multiple changes over thousands of years. It's not really possible to rule out fluctuations on short (roughly a century) time scales from the data, because the resolution of proxy data (even leaving aside all the other possible issues with it) is just not that good; it has error bars at least a degree wide and a time resolution that might not even be as short as a century.

Also, "within a generation" is too short even for the change that's happening now. We're talking a time scale of a century or so; that's multiple generations.

I don't think this qualifies as a valid source. I don't see a reference to an actual peer-reviewed paper.

In any case, I think we're getting off topic for this discussion (and also possibly pushing the boundaries of PF rules about climate change discussions). The original item that started this subthread was a carbon tax. I think @anorlunda summed that up well enough here:

I personally do not favor a carbon tax as a policy, for the reasons I've given, but I agree that it's less dangerous than putting a thumb on the market's scale. So if the only policy choices were carbon tax and thumb, I would pick the tax as less dangerous.

Weather in many places has been getting more extreme already. We know the impact on coral reefs, we know the impact of rising sea levels and we know both will get worse. One million species are at risk of extinction and climate change is one of the important reasons. And so on. Meanwhile positive effects are very rare.

That is the current level. Even if we would stop all CO2 emissions tomorrow we would get a bit more warming, but a full stop tomorrow is purely hypothetical. We will see the temperatures rise more. How much? That depends on future emissions. Even if you think the changes so far don't matter at all and only future changes can be bad: Even then CO2 emissions have a net negative impact.

Over thousands of years, not within a generation. And with colder temperatures. xkcd has a graph.

It is? I thought it was generally agreed that it's not a net negative until global average temperatures get another couple of degrees higher. But even that is based on a lot of assumptions that are very uncertain. I don't think we understand the problem domain well enough to know what the current net impact of CO2 levels increasing is.

But it also changes the hydrologic cycle–increased temp generally means more evaporation, hence more clouds, hence more precipitation, which transports more heat from the surface to the upper atmosphere. This is shown as "latent heat transport" in the energy budget diagrams, but as far as I can tell we have a very poor understanding of how much that heat transport number increases with temperature. It wouldn't take much of an increase to offset the effect of more average water vapor in the atmosphere, so it seems like there's a lot of uncertainty here that we have no good way to decrease at present.

I don't just wonder that we might be underestimating this, I think we almost certainly are underestimating this. Global average temperatures changed by something like 0.6 C during the 20th century–and what's more, it wasn't a linear change, there was early 20th century warming, followed by mid 20th century cooling, followed by late 20th century warming. We adapted through all of that. And over historic times humans have adapted to larger changes than that.

Quite correct. Early retirement brings financial disruption and it scares investors for future projects. We see evidence of that. New natural gas plants with a 30 year lifetime, are finding that prospective investors demand a 5 year ROI because of future uncertainty. That greatly increases the capital costs and it adds to rising prices for consumers.

To be fair, the original investors may fully depreciate a plant earlier than its expected lifetime. That makes writeoff date and planning for replacements semi-independent.

Threats of future restrictions, or taxes also spook investors and makes them demand very short time ROI. That is not only costly up front, it also changes the generation mix. Nuclear plants with long project and construction times, with many threatened government actions, and with long ROI, are particularly hard to sell to investors. Wind and solar farms can be built on shorter schedules and shorter ROI. If investors can return their money and profit with just 5 years of subsidies, they can plan to abandon the facilities after 5 years if things change.

Future planning is essential because of the critical need for reliable power, and because of long lead times on many projects. But unforeseen disruption can ruin plans, causing chaos. Chaos threatens the reliable and affordable supply of power, and promotes haste and crime. That is the main message of the article. chaos=bad.

Not if you assume that the effect of CO2 emissions is net negative, no. But I am also highly skeptical of that assumption. Just on the most basic heuristic level, CO2 adds something to the greenhouse effect, but also increases plant growth. Which effect dominates under our current conditions? Nobody knows for sure. And that's just the most basic heuristic; a really proper treatment would require a precision of economic modeling that we don't have.

Yes, this I agree with.

Regulators here issue REGO (Renewable Energy Guarantee Origin) certificates to renewable energy generators for each MWh they produce. These certificates are used to prove statements made about the Fuel Mix a particular energy company claims to deliver.

Unfortunately these certificates can be traded. So an energy company can buy electricity from a fossil fuel fired power station and market it as 100% renewable as long as they buy the corresponding number of REGO certificates.

For some reason these certificates trade for around £1 each. So the cost to an energy company per customer is virtually negligible. This means it's way cheaper to by electricity from a fossil fuel generator and green wash it by buying an REGO than it is to buy electricity from a renewable source.

Last year one company supplied 3.7% of their electricity from renewable generators, this year buy buying REGO they are able to claim all their electricity is 100% renewable.

Your right. My number was misleading because of that.

The near future for installation of utility-scale PV is complicated because we expect many solar farms to be upgrading with new panels; perhaps once every 3 years. That partially re-uses existing installation investments. That is good, but makes forecasting more difficult.

I would be really surprised if installation costs can drop that much. The modules – maybe.

Well, it is certainly not zero. The pollution from ash is easier to estimate, and that alone would make coal not competitive any more.

This assumes that the government has accurate knowledge of what those costs are. I'm highly skeptical of this assumption in the case of carbon.

That is what I call "tinkering" with the markets. Put in market features that are not fully understood, then adding urgent patches as the negative consequences become clear. Then patching the patches. That in a nutshell, is what made California vulnerable to Enron in the year 2000. When you tinker, you leave loopholes.

The problem is that the wholesale markets that the ISO runs are so abstract, and so removed from a consumer's monthly bill that the public doesn't understand, and the public is totally uninterested in these issues. Public opinion is more easily driven by inflammatory sound bites, and doomsday predictions.

In fact, unless there is a blackout or an impending crisis, the entire power grid is a crushingly boring subject for most people. I've learned from a lifetime as a power engineer, if I answer the question "what do you do?" at a party, the result is that people instantly walk away or change the subject. (Fortunately for me, I met my life's love before becoming a power engineer. :-)

Please please, fund me to do that simulation. That has been my wet dream for decades. Not just me, but lots of other engineers. There have been several attempts, but the problem is difficult. You simplify enough to make it practical, then the results are doubtful because of the simplifications. It lies somewhere between first principle physics and economics, and predicting future Dow Jones stock prices.

I'm sure that's true, but there is a Moore's Law – like evolution going on here. Solar PV costs halve every 3 years. Wind is also making fast strides. Therefore, what failed 3 years ago, might thrive 3 years from now. Policy based on a 10 year future horizon is a pretty good way to do it.

Traditional power engineering thinks of physical facilities having a 40 year lifetime. That it challenged of course in a rapidly evolving world, but still 10 years per time step is not bad. So looking forward one step, I think of solar prices as ##2^{-3}## times today's price as a planning figure. That is clearly in the no-subsidy-needed range.

Pure storage solutions are somewhat close to this – they use their reserve capacity (unlike your hypothetical plant) but they don't produce net electricity overall.

Germany's new solar installations dropped to essentially zero after the subsidies for new installations reached 120 Euro/MWh. At that level you wouldn't expect the market dynamics to be very important for the decision for or against new installations – you live from the subsidies anyway.

I see a carbon tax as pro-market. Let the power plants pay for the external costs they cause.

Coal power plants would have gone out of business long ago if they would have to pay for the pollution and follow-up costs from CO2 emissions they cause.

If I misunderstand, I apologize. But the 2nd quote sounds like your remedy is to bake in capital, maintenance, and other types of costs into the $/kWh figure. That is the oversimplification that doesn't work. To fairly compare something like PV versus hydro, you need a whole sheet of paper (maybe a whole book) to describe each alternative, not a single number. You need it because they really are apple and potatoes. You need it because factors such as reliability, project duration, permit requirements, speed of response, available contractors, land footprint, scalability, and many properties other than power generation are significant in a comparison.

Not all issues can be settled in an online debate, or by a single sentence in an article.

And a worldwide power distribution network that could handle that level of demand.

I keep trying to tell you that reducing everything to $/kWh is oversimplifying. The difficulties you're having are of your own creation because of that oversimplification.

When real investors compare alternative A with alternative B, they may examine dozens of properties.

You must add diversity to be able to say that. With wind, you mentioned multiple sites. With solar, no amount of extra panels will make power at night.

Surplus capacity helps only when the intermittent fluctuations are quasi-random. There are also transmission limitations that make it difficult and expensive to share wind or solar diversity between say Vancouver and Halifax.

On a seasonal time scale, hydro is intermittent.

We are familiar with 24 hour cycles of intermittent load demand. On the time scale of decades, load demand can also be intermittent. Think of the great depression, followed by WWII.

To make good policy, one must simultaneously consider all relevant technology, geography, and time scales.

Thanks for that information @Rive . It helps illustrate the point. Some people may think Germany was too heavy handed in that action, but South Australia was too light handed. Both cases argue for putting level-headed analytical engineers like me

in charge of policy instead of politicians, lawyers, and voters.

in charge of policy instead of politicians, lawyers, and voters.

Good example. In the article, I stress thinking on the continental level. Extrapolate more into the future. It is foreseeable that there can be so much North Sea wind power, that Switzerland, Italy, the Balkans, Greece and Turkey all want a share of it. What will the NIMBYs say about those power lines?

https://www.physicsforums.com/threads/solar-pv-versus-solar-thermal.971189/

That's a good thought.

A resource does not need to be 24x7x365 to be useful.

Also, I think storage is considered a separate entity than the intermittent generation even if they are owned by the same party. Why? Because each resource has advantages and disadvantages, and should be free to bid separately to maximize their usefulness and their payments. Constraining the two to be coupled may be sub-optimal for the owner.

But most important, the market does not choose anything based on estimates. It chooses based on bids. It is recommended that owners bid their marginal costs, but it is not a requirement. Therefore, we can not assume that bids reflect costs.

Remember that accepted bids are paid the clearing price, not their bid price.

Those are all fair points, and deserve good answers.

Solar and wind will be expanded and utilized ASAP with or without climate concerns. They continue to have competitive cost advantages that assure that they generate as much as practical without giving them any unfair advantages. With less confidence, I also believe that withdrawal of all subsidies, priorities, and preferences would not slow down the growth of renewables significantly.

I think it depends on who you talk to.

…sorry to hear that. Solar thermal has not shown it is viable, which is why implementation has basically halted.

The original issue that made renewable energy a thing was predictions, made in the 1950s, 60s, and early 70s, that we would run out of oil, or more generally fossil fuels, some time or other around now. That is still a significant driving force behind renewable energy and has nothing to do with de carbonizing for climate change reasons.

BINGO! You hit the nail on the head.

Even if we switched to climate rather than money as the optimized quantity, there is still competition between suppliers, and there is still incentive to cheat.

To amplify Russ' point: I could attach button-sized carbon scrubbing filters to the blades of my windmill, claim climate friendliness superior to competing windmills and demand 100x the normal price for my power. Of course that's technically absurd, but it takes time to plug loopholes.

I recommend the book "The Smartest Guy In The Room". It documents how Enron used dozens of absurd loopholes to cheat the public and make themselves rich. Enron got caught, but not before millions in California were harmed. The dangers I fear relate to inadvertent creation of loopholes as we undergo the transition Russ described.

You're free to have your own preferences of course, but that ratio you use attaches zero value to services other than energy. It is hypothetically possible to build a power plant that sells nothing other than reserve capacity, never generating a single MWh in its lifetime. That makes your ratio zero, yet the plant still provides a valuable needed service to the grid, and deserves a share of revenues. The plant's profitability is a separate question.

So I'm free to reject your analysis as oversimplified. Those separate revenue streams compensate providers of different, but related, services. To make an analogy with cars, we pay the manufacturers, the fuel suppliers, and the highway builders separately, even though they all contribute to transportation. You could convert all that to cost per passenger mile, but I don't see that as being helpful.

Another disagreement. Carbon can be a constraint, but never the goal of producing and delivering electric power. Affordable reliable power is essential to our civilization.

IMO, overpopulation rather than climate is our most urgent problem. I'm sure many will disagree with that.

That's ok (if hard to predict) for planning purposes, but doesn't really address the topic of the article.

And the "hard to predict" isn"t just an understatement, but also the system is currently rigged in favor of renewables. When that math is used for a new solar plant it nullifies the calculation that justified building a conventional plant 40 years ago. That's in part why nuclear plants are closing and low capital cost fossil fuel (natural gas) plants are growing; their math is less affected by that slanted and unstable playing field.

But at some point, whether policy makers choose to deal with it or not, that tilted playing field will start affecting solar. At that point, someone will build a new solar plant that causes other solar plants to have to curtail production on their best days. That's when solar implementation hits the ceiling.

Edit: New York funds storage projects..

Greentech Media News: New York’s Energy Storage Incentive Could Spur Deployment of 1.8GWh.

http://feeds.greentechmedia.com/~r/…age-incentive-could-spur-deployment-of-1-8-gw

Talk about risks. My article was so wordy that I'm afraid that not everyone read it to the end. Sure there are captital costs, fuel costs, maintenance, operating, marginal, average and more. But there are also multiple sources of revenues to the owners, not just kWh energy.

The energy market described in the article uses primarily marginal costs to determine the optimum, and it compensates the owners for their marginal operating costs.

The ICAP payments, directly compensate owners for their capital costs. To a lesser extent, so do payments for providers of reserves, frequency control, and voltage support. All of those payments are for capabilities, not for generating energy.

I think the debate in this thread about marginal costs was caused by an attempt to assign all types of costs on to one measure, one kWh of energy. That oversimplification ignores those other forms of revenue streams.

Those markets I described were designed by the actual participants. That means the people who buy and sell wholesale power. The designs are constantly tweaked. All those people, each looking out for their self interest assures that no source of value, goes unrewarded. But again, let me stress I speak of wholesale markets, not retail. They are transparent and open for scrutiny, but they seldom attract press attention because it is so difficult to relate what happens there to a consumer's monthly bill. Remember, I mention in the article wholesale prices change every 15 minutes, but rates charged to retail customers are set by law and typically stay constant for a year or more.

You're correct, in southern California home rooftop solar has already grown to a very significant portion.

When tinkering with such critical things as the electric infrastructure, and hundreds of billions of dollars, the word prudence ranks extremely high in the minds of designers. But the prudence of central planning is hard to apply to a wild-west environment where every homeowner makes his independent decisions and who also lobbies his congressman.

I should also mention a huge factor the article doesn't address. How specifically are owners of power transmission lines compensated for their investments and services? That is even more abstract and difficult to understand than energy generators/consumers. It can also be big bucks, with up to $3 billion for each major new line. And with renewable advocates calling for 250K new miles of HVDC lines in America, and 500K new km in Europe, the magnitude of the transmission problem could itself become dominant.

In the article, I allude to political problems if the needs of high density cities diverge from everyone else. Distributed generation and high rise apartment buildings don't dance well with each other. In the USA, it is roughly a 50-50 split between people in single-family multi-family dwellings. That same split has a high correlation to red/blue political views which makes it even more volatile.

I love this topic precisely because it requires so many disciplines. Energy conservation, Ohms Law, economics, politics, cybersecurity. To me, it will never be boring.

Could you comment though on how you see distributed production and storage fitting into that? To me, if one house puts up a solar array, that's an individual house issue — but if EVERY house puts up a solar array (as California claims they are going to mandate), that's a grid issue. Similar examples would be the tesla powerwall and load shedding/scheduling at an end user level, but under grid control.

Just one small scenario, but I see a potential problem if the power company is legally mandated to buy every kWh residential solar arrays produce, at a fixed rate, while curtailing or negative-price selling other sources. What would happen if residential solar got so big it provided more power than the grid could absorb? Do you refuse the power but pay the "customer" for it anyway? And what does that do to the utility generators?

I've put a lot of thought into the technical problems of integrating a high fraction of intermittent renewables, but to be honest I'd never really considered the grid collapsing for largely economic reasons. But I suppose the current fights over nuclear power receiving "renewable" energy credit – or shut down – are an early manifestation of that.

I don't think "political" is the right word. I think it's consumer/culture (or consumer-culture) driven. And I see two ways to look at it:

1. It's expected because it's expected.

For most of us, losing power is such a rare and unexpected event that we see it as a tragedy. But for most of us, a few hours without power barely affects us at all at home and at worst with a business sends you home early. No big deal, right…?

…Well actually, it *IS* kind of a big deal:

2. Our infrastructure is designed under the expectation that it's expected. Because our infrastructure is designed under the assumption that our power is reliable, most of us have no backup. A few hours of lost productivity every week is a potentially big deal for the economy, and a few days is all it takes before people start dying due to lack of HVAC in some locales. Critical businesses have local backup generators and in a place like Puerto Rico most businesses of any significance do as well (restaurants, banks, hotels, etc), but even then after a few days they run out of fuel, which caused a lot of deaths in Puerto Rico and a few in Florida. And the article even describes how the grid has a difficult time re-starting from an outage; a system designed never to be turned off isn't necessarily designed with good provisions for re-starting.

I think it is reasonable to expect power to always be available, but I think it is also reasonable to question whether that power has to come from the grid. Or, perhaps, what might happen is that if more power generation and storage becomes distributed, the grid's reliability or at least excess capacity can go down without the perceived reliability at the end user being affected.

The article mentioned how it's currently possible in many places to voluntarily allow your reliability to be reduced in exchange for a lower rate/credit. These are somewhat predictable, weather-based programs and you generally receive a certain amount of notice. It might be up to 10 days, for 4 hours at a time (IIRC), on the hottest days of the year, the electric company will notify you that you have to decrease your usage by a certain amount. This voluntary load shedding prevents blackouts and/or reduces the need for additional new power plants.

My electric company had a similar provision for automated load-shedding of residential customer HVAC. Perhaps if systems such as the Tesla Powerwall become more prevalent, they can be incorporated into such programs. I think I've heard of smaller appliances potentially having this capability in the future, which you were alluding to as well.

That's where the issue is. One of the key points regarding the grid is that it never runs at full load. There must always be spare capacity. Management of that is one of the key components of running the grid. It may be easiest to see if we flip it over: the cost of putting out one LESS kWh instead of one more.

And one of the key points of the article (perhaps even the entire thesis) is that *today* the intermittent renewables can ignore that issue and just provide 100% of their currently available power (almost) all the time, but in the near future their need to run at less than full capacity for a significant amount of time and kWh will become a big problem – as much because of the business model of the grid as for the engineering.

You can't always generate at 100% capacity. First, the sun isn't always shining; second, the grid can't always accept what you are generating. That's the whole point of @anorlunda's article, to explain how the process of allocating the load (power demand) among the various possible sources (power suppliers) actually works. It's a lot more complicated than you appear to be assuming.

The specific point I've been trying to make (or rather reinforce, since @anorlunda originally made it) is that the optimal strategy in the bidding process @anorlunda describes for a supplier of solar power is very different from the optimal strategy for a supplier of, say, natural gas or nuclear power, and a key factor that makes the difference is that the marginal cost to the solar power supplier of each additional watt generated is zero. The cost you keep talking about is the average cost, but that is not the cost that plays a primary role in determining the optimal strategy; the marginal cost is.

It does not affect the marginal cost per watt, as I've repeatedly explained. I'm beginning to wonder whether you have actually read my posts.

As I said above, bidding strategy is a lot more complicated that you appear to be assuming. The article goes into this in some detail. I'm beginning to wonder whether you have actually read the article.

In principle they could, yes. But they don't. Why do you think that is?

If the plant was subsidized, that would make a big difference to this business case, wouldn't it?

No, they're not, because the cost you are paying is not for generating the watts; it's paying off the capital investment, and, as you yourself point out, that amount is the same regardless of how many watts the plant generates. So, again, the marginal cost of an additional watt, which is what @anorlunda was talking about, is zero (if we leave out maintenance cost). The average cost per watt will be different depending on how many watts are generated, but that's not the important cost if you're trying to understand bidding strategies and the stability of the energy markets.

Capital cost is not operating expense. Capital cost is what you pay up front.

Maintenance is a genuine operating expense, yes, and it means the marginal cost of generating an additional watt is not exactly zero; there is some positive marginal cost. But it's still much, much smaller than for a type of plant that requires fuel, and its relationship to the number of watts generated is also much less straightforward.

You're missing the point. The fact that the capital cost is sunk does not mean it can be "shrugged off". It means that it's already been spent before the plant starts operating, and it is the same whether the plant generates zero watts or a billion watts.

Nor does that mean the capital cost has no impact on the bidding strategies that are used in the markets @anorlunda described. Obviously it must have an impact, since those costs, as I've just said, cannot be just "shrugged off". Unless, of course, they were subsidized–which means that subsidies do in fact make a big difference.

You left out the key qualifier he gave: "once installed and ready". He is talking about the marginal cost per additional watt generated, not the average cost per watt obtained by dividing the capital cost by the total number of watts generated. His point is that once you've built the thing, the capital cost is a sunk cost; it's there no matter how many watts you generate. But the additional cost of generating more watts is zero. That means the bidding strategy of someone who has built this kind of system will be very different from the bidding strategy of someone who has built a system with a nonzero marginal cost to generate additional watts (for example, the cost of the additional fuel needed to generate those watts).

Yes indeed. Some home loads, notably hot water heating, have great flexibility in when we schedule them.

But please stick with the actual article topic:

Could you imagine your submarine being built without the aid of electricity? Could you imagine PF without electricity?

But we need contrarian views sometimes. You can fill that role for us re: electric power.

Synchronous condensers, batteries and pumped hydro can all be mixed with renewables to provide some of the missing functions. Is there anything that can’t cover?

The need for such fixes does not rise linearly with the incursion of renewables, I believe. E.g. I’ve heard they could go to 40% with little other modification to the grid. Do you have any projections for how the costs of renewables and storage will fall, and how that will shift the least-cost balance? (I think it is reasonable to allow for some continued subsidy to represent the social cost of carbon).

Any kind of "must run" situation. Perhaps the chairman is coming to see a demo of the new features.

But in terms of repeatable behavior, those are the only two cases I can think of.

A zero bid is more common. We call that "price takers" I want to sell at any reasonable price, not matter what the price. We do the same when selling stock. We give an order "sell at market" which means I want them sold regardless of market price. But in the stock market we never see negative prices.

No. It is a direct consequence of subsidies. I thought I said that in the article.

But it does point that subsidies destabilize the markets and that as solar&wind grow to a bigger fraction, the subsidies must cease at some point.

But even without subsidies, a flat price curve where costs do not vary in proportion to power produced is also destabilizing of the markets. That is pretty much true of wind & solar. Once installed and ready, the incremental cost to make one more watt is zero.

Thanks Peter, I may revise the article to more clearly separate subsidies versus flat curves.

Similarly, the ICAP market is destabilized by state mandates regarding the percentage of renewable power. If I have some solar, and if the state mandates that solar bids must win, then I can set the price as high as I want. The only thing that would prevent that would be competition from other solar and that the sum of all solar capacity exceeds 100% of needs.

All viable markets, stocks, energy, pork futures, …, require sufficient competition so that:

(1) Are there reasons for negative bids other than the two mentioned in the article (nuclear not being able to shut down/start up quickly, and solar/wind being subsidized)?

(2) Would solar/wind ever be able to make negative bids if they were not subsidized?

At a much lower population, with a much lower standard of living, with much slower communications…

There are still places today where there is not a reliable supply of electricity. I would not want to live in any of those places.